|

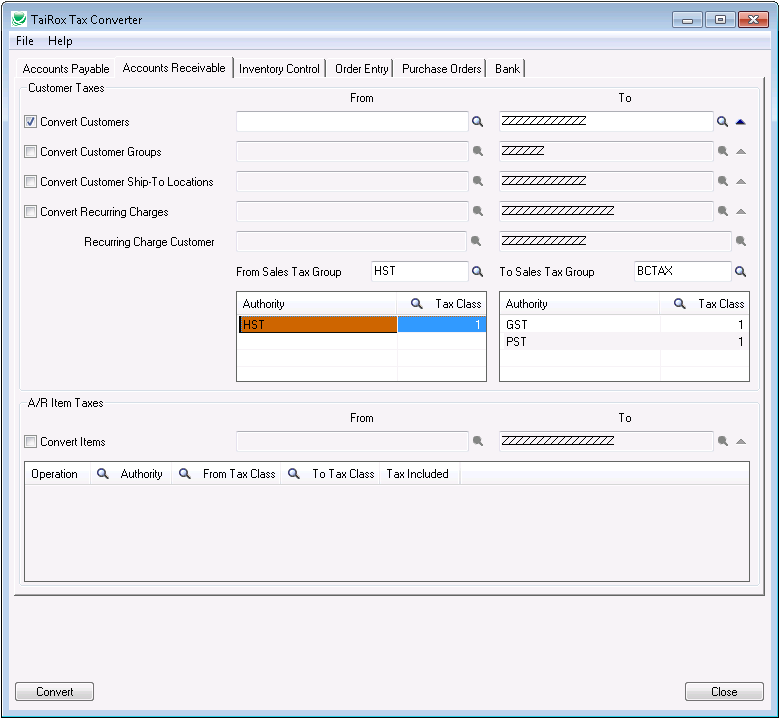

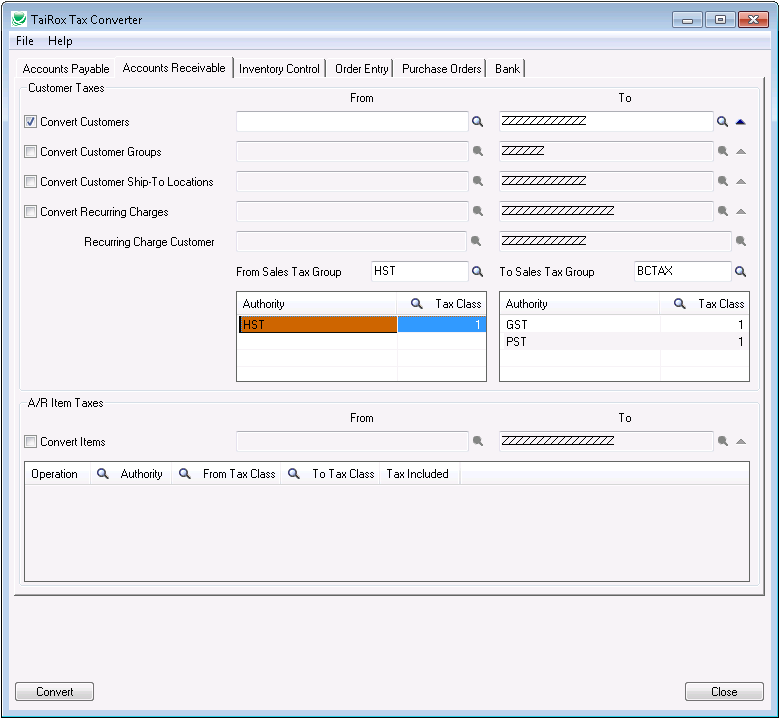

Tax Converter

|

|

Available for $595 + $150 per year,

Tax Converter is a utility to be used with Sage 300. This utility saves time

and reduces opportunities for error during a tax conversion.

|

|

|

*New*

Support has been added for Sage 300 2021.

|

|

|

HST / PST / GST Conversion in Sage 300 is not as simple as changing a tax rate.

Manually changing Tax Groups

on dozens or hundreds of customers, vendors, items, item prices and related entities is time

consuming and subject to entry error. Using the Import/Export capabilities in Sage 300

and manipulating spreadsheets may save some time,

but involves steps and formulas which are also subject to error.

|

|

|

While Tax Converter was initially developed for the Canadian BC and

Ontario HST (Harmonized Sales Tax) conversions for July 2010, it is a

general purpose utility that can be used in any situation when Sage 300 Tax

Groups, Authorities and Classes must be changed. The examples in the user

guide describe a conversion from HST back to GST / PST - such as what

happened in British Columbia in 2013.

|

|

|

|

| Features and Benefits |

| • | Tax Converter replaces clumsy manual or import/export schemes with a properly built Sage 300 SDK solution. |

| • | Targeted for Canadian HST conversions, but not restricted to HST, it is a general purpose tax conversion program that can be used in any country. |

| • | Tax Converter will perform one-to-one, one-to-many, many-to-one or many-to-many changes to Tax Authorities within a Tax Group. A typical HST scenario would involve combining the GST and PST Tax Authorities into an HST Authority. This would take place in a tax group such as ONTAX or BCTAX. |

| • | Tax Class changes can also be done if required by the new tax regulations. In the HST scenario, these adjustments may be required special tax exclusions. |

| • | Situations requiring intervention are flagged and placed into the log. For example, when combining GST and PST into HST for a tax-exempt customer, there may be 2 tax-exempt registration numbers to be reconciled. |

| • | A complete log of changes is kept, insuring no data loss. |

| • | Uses Sage 300 business objects, insuring the consistency of resulting data. |

|

|

| Platform Requirements |

| • | Sage ERP Accpac version 5.6 to 6.0 or Sage 300 2012 to 2021 |

| • | A single executable program works with all platforms |

|